The number of newly signed orders increased by 8 ships from the previous month, with Chinese shipbuilders receiving the most orders and South Korea second.

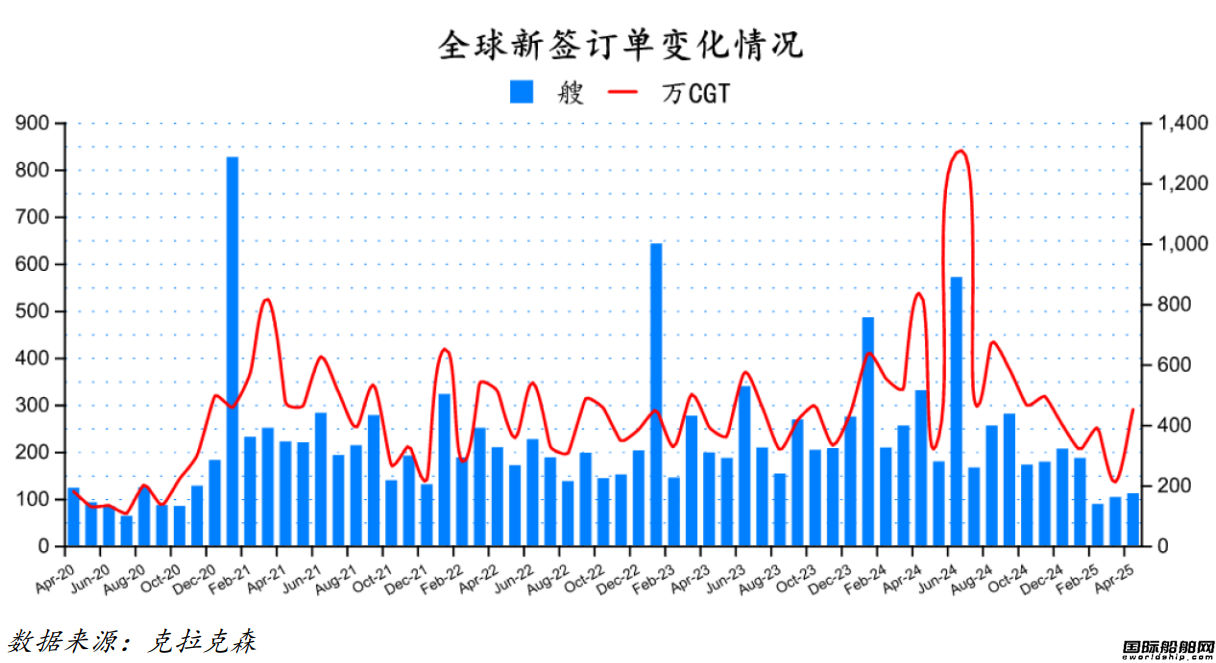

According to the latest statistics from Clarksons (as of May 9, 2025), there were 111 new orders signed globally in April 2025, totaling 4,532,855 CGT. Compared with 103 new orders signed globally in March 2025, totaling 2,129,421 CGT, the number increased by 8 ships and the modified gross tonnage increased by 112.87% month-on-month. Compared with 330 new orders signed globally in April 2024, totaling 8,340,222 CGT, the number decreased by 219 ships and the modified gross tonnage decreased by 45.65% year-on-year.

In terms of ship types, there are 7 bulk carriers with a total of 351,500 deadweight tons; 14 oil tankers with a total of 2,836,300 deadweight tons; 5 chemical tankers with a total of 213,000 deadweight tons; 53 container ships with a total of 599,610 TEUs; 8 liquefied gas tankers with a total of 440,000 cubic meters; 14 other ship types with a total of 898,996 CGT; 10 offshore vessels with a total of 135,138 CGT. In terms of order types, 7 large handy bulk carriers were newly signed for bulk carriers; 5 VLCCs, 8 Suezmax tankers and 1 small tanker were newly signed for oil tankers; 34 post-Panamax container ships, 10 sub-Panamax container ships, 8 handy container ships and 1 feeder container ship were newly signed for container ships.

In terms of the countries of the shipyards that received the orders, there were 111 new ship orders worldwide in April, totaling 4,532,855 CGT, of which Chinese shipyards received 55 ships totaling 2,601,584 CGT; Japanese shipyards received 4 ships totaling 140,809 CGT; and South Korean shipyards received 42 ships totaling 1,313,352 CGT; their modified gross tonnage accounted for 57.39%, 3.11% and 28.97% of the global new ship orders respectively.

From January to April 2025, there were 488 new ship orders with a total of 30,522,431 deadweight tons, which was a year-on-year decrease of 61.82% and 51.66% respectively compared with the 1,278 new orders with a total of 63,144,517 deadweight tons in the same period of 2024. In terms of ship types, there were 41 bulk carriers with a total of 3,032,865 deadweight tons; 47 oil tankers with a total of 5,529,224 deadweight tons; 51 chemical tankers with a total of 1,305,600 deadweight tons; 148 container ships with a total of 1,637,371 TEUs; 30 liquefied gas tankers with a total of 1,641,800 cubic meters; 99 offshore vessels with a total of 701,733 CGT; and 72 other ship types with a total of 2,407,641 CGT.

From a country perspective, China signed new orders for 240 ships, totaling 7,050,531 CGT; Japan signed new orders for 49 ships, totaling 765,090 CGT; South Korea signed new orders for 85 ships, totaling 3,487,404 CGT; their modified gross tonnage accounted for 51.15%, 5.55% and 25.30% of the global new ship orders respectively.

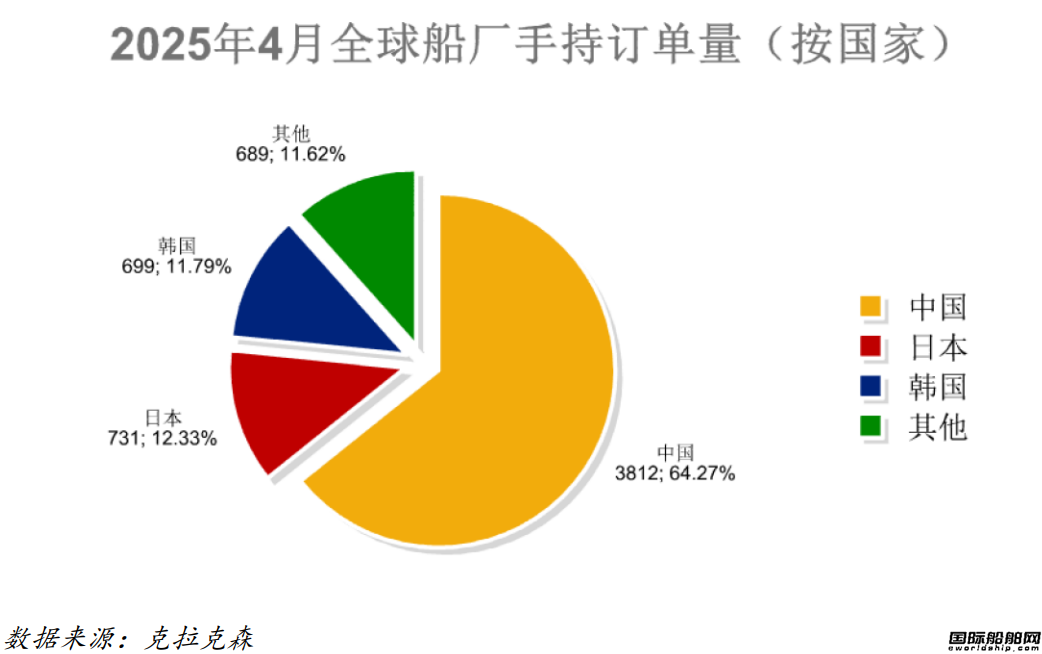

The global order book is 5,931 ships, of which 3,812 ships are from Chinese shipyards, accounting for 64.27% of the global market share.

According to statistics, as of May 9, 2025, the global shipyards have 5,931 orders, totaling 160,455,580 CGT. Compared with the 6,022 ships and 162,389,147 CGT counted on April 10, 2025, the number of orders on hand fell by 1.51% month-on-month, and the modified gross tonnage fell by 1.19% month-on-month.

Among them, the number of orders on hand for Chinese shipyards is 3,812 ships, totaling 95,822,879 CGT, accounting for 64.27% of the global market share in terms of number of ships and 59.72% in terms of CGT; the number of orders on hand for Japanese shipyards is 731 ships, totaling 13,387,119 CGT, accounting for 12.33% of the global market share in terms of number of ships and 8.34% in terms of CGT; the number of orders on hand for Korean shipyards is 699 ships, totaling 36,183,779 CGT, accounting for 11.79% of the global market share in terms of number of ships and 22.55% in terms of CGT.

In terms of major ship types, the number of orders for bulk carriers on hand is 1,333, with a total of 107,687,177 deadweight tons; the number of orders for oil tankers on hand is 1,492, with a total of 105,232,015 deadweight tons; and the number of orders for container ships on hand is 883, with a total of 9,428,780 TEUs.

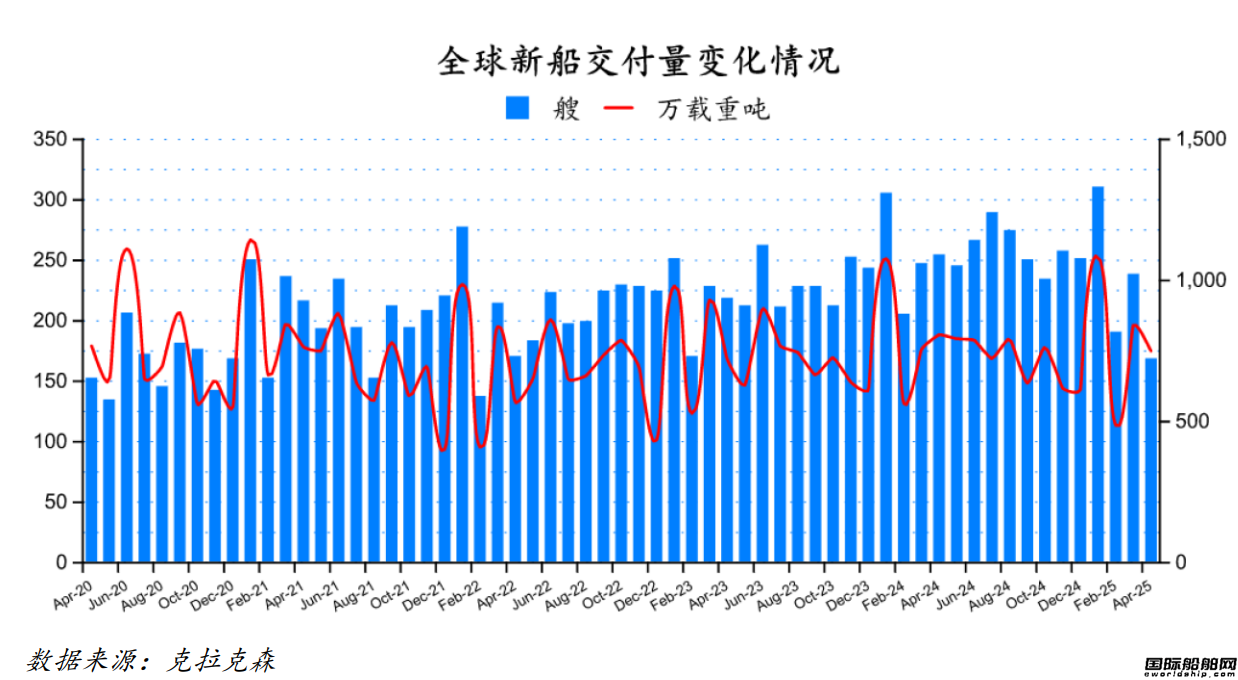

Completion volume decreased by 10.91% month-on-month, with bulk carriers and container ships delivering the most

In April 2025, global shipyards delivered a total of 168 new ships, totaling 7,503,743 deadweight tons. Compared with the global new ship delivery orders of 238 ships, totaling 8,422,687 deadweight tons in March 2025, the number decreased by 29.41% month-on-month, and the deadweight tonnage decreased by 10.91% month-on-month. Compared with the global shipyards delivered a total of 254 new ships, totaling 8,081,159 deadweight tons in April 2024, the number decreased by 33.86% year-on-year, and the deadweight tonnage decreased by 7.15% year-on-year.

In terms of ship types, 34 bulk carriers were delivered, totaling 2,496,451 deadweight tons; 22 container ships were delivered, totaling 193,008 TEUs; 13 oil tankers were delivered, totaling 1,179,675 deadweight tons; 17 chemical tankers were delivered, totaling 451,107 deadweight tons; 7 liquefied gas tankers were delivered, totaling 862,500 cubic meters; 38 offshore vessels were delivered, totaling 341,566 deadweight tons; 37 other ship types were delivered, totaling 351,984 deadweight tons.

From January to April 2025, global shipyards delivered a total of 906 new ships, totaling 31,662,101 deadweight tons. Compared with the global new ship delivery orders of 1,011 ships and a total of 32,061,689 deadweight tons in the same period of 2024, the number decreased by 10.39% year-on-year, and the deadweight tons decreased by 1.25% year-on-year.

In terms of ship types, the number of bulk carriers delivered was 181, totaling 12,583,698 deadweight tons; the number of container ships delivered was 96, totaling 757,321TEU; the number of oil tankers delivered was 62, totaling 4,132,192 deadweight tons; the number of chemical tankers delivered was 69, totaling 1,858,417 deadweight tons; the number of liquefied gas tankers delivered was 38, totaling 4,507,924 cubic meters; the number of offshore engineering ships delivered was 297, totaling 556,821 deadweight tons; the number of other ship types delivered was 163, totaling 1,478,458 deadweight tons.

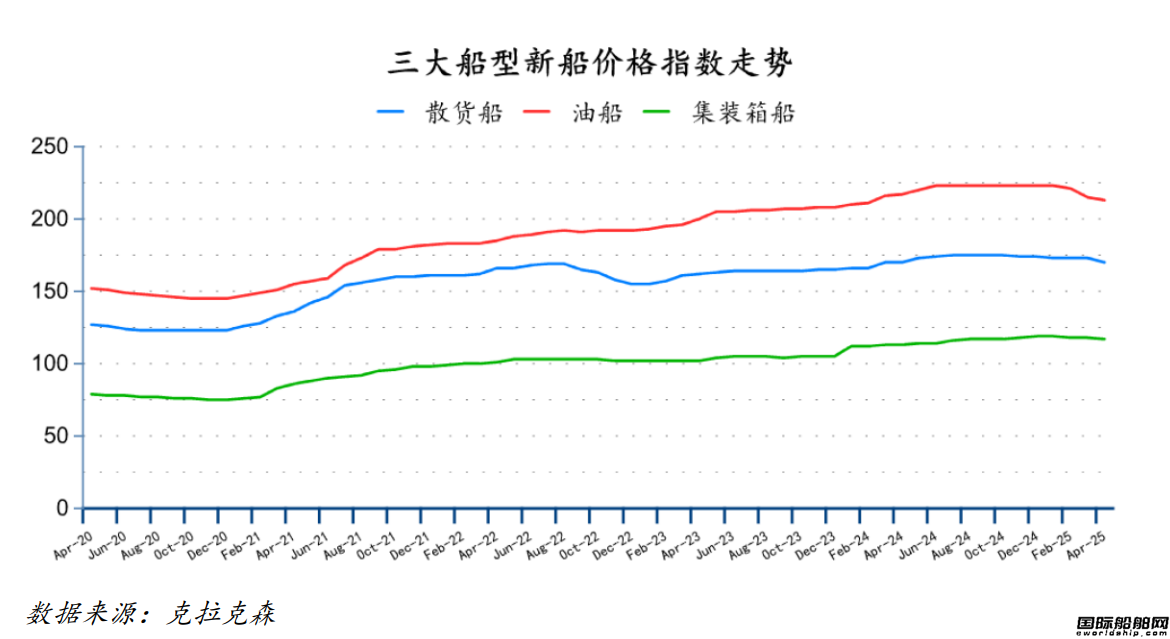

Prices of new ships of the three major ship types all fell

In April, the new ship price index of bulk carriers, oil tankers and container ships fell by 3 points, 2 points and 1 point month-on-month to 170 points, 213 points and 117 points respectively.

In April, the new ship prices of various types of bulk carriers fell month-on-month, among which the new ship prices of Capesize bulk carriers (180/182KDWT), Panamax bulk carriers (82/84KDWT), Handysize bulk carriers (61/64.5KDWT) and Handysize bulk carriers (25/30KDWT) fell by US$500,000, US$500,000, US$500,000 and US$450,000 to US$73.5 million, US$36.5 million, US$34 million and US$26.93 million respectively.

The prices of new oil tankers, except for VLCC (315-320KDWT) which remained unchanged, all other types of new oil tanker prices fell, of which VLCC (315-320KDWT) was US$125 million; the prices of Suezmax (156-158KDWT), Aframax (113-115KDWT), Panamax (73-75KDWT) and Handymax (47-51KDWT) fell by US$1 million, US$500,000, US$500,000 and US$500,000 respectively to US$86.5 million, US$72.5 million, US$59 million and US$49 million.

The prices of new container ships, except for Panamax container ships (3700-4500TEU) which remained unchanged and sub-Panamax container ships (2600-2900TEU) which increased, the prices of other types of container ships all fell. Among them, the price of Panamax container ships (3700-4500TEU) was US$61 million; the price of sub-Panamax container ships (2600-2900TEU) increased by US$1 million to US$45 million; the prices of post-Panamax container ships (22000-24000TEU and 13000-13500TEU), Panamax container ships (8500-9500TEU), handysize container ships (1850-2100TEU) The prices of new ships of 1000-1200TEU and 1000-1200TEU) decreased by USD 500,000, USD 2 million, USD 1 million, USD 500,000 and USD 250,000 month-on-month to USD 273.5 million, USD 180 million, USD 129 million, USD 32 million and USD 24.75 million respectively.

Copyright © Whale Marine Product Co.,Ltd. All Rights Reserved | Sitemap| Powered by